Several years ago at our neighborhood school bus stop, three siblings would hop off every other Wednesday afternoon. Their single mom worked a smattering of seven jobs, and their uncle provided their care on those afternoons until their mom was finished with work. He worked nights, so they had a key to let themselves in while he slept. One bitterly cold and windy Wisconsin day (-15* F), the kids knocked on our apartment door after school. The eldest, a 4th or 5th grader (around 10 or 11), didn’t know what to do. Their key wouldn’t work in the frozen lock (this can happen in the cold), and they couldn’t rouse their uncle to let them in. Fortunately, they made the decision to give up trying and, somehow remembering where the only other people they’d met in the strange neighborhood lived, made the trek over. I shudder to think about what might have happened, had they landed in a more rural situation; but what if they had? What if they’d suffered from frostbite, or worse? Whose fault would it have been? The uncle? The mom? The kids? The school bus driver? The lock manufacturer? The question of “fault” distracts from the real issue. Why does the mom need seven jobs in the first place? Why do the kids need to be shuttled around on a 2-week rotation between family, friends, and acquaintances, so their welcome is never worn out and they are kept safe? Why does our system make surviving from day to day so difficult?

For anyone that has held more than one job, you know the headache of trying to organize a work schedule, particularly one that has inconsistent hours: more so when trying to care and provide for children. Each job demands one’s ultimate loyalty in hours, availability, and priority, no matter how many hours are given, or how much loyalty is returned. Some employees are expected to: give their time freely for extra cleanings and meetings; be readily available to fill in when someone calls in sick; constantly change their schedules to accommodate the needs of the job – losing hours if closing early, splitting shifts to cover the busy hours of the day (such as the morning and evening rushes while the ‘dead’ hours between shifts and travel time/costs are born by the employee); and making arrangements when shifts vary drastically from week to week – keeping track of it all. At times it can seem that the lowest paying jobs demand the most loyalty while having the most hurdles. (Many of these jobs were labeled “essential” during the pandemic; though risks increased, pay did not.)

Why have more than one job? To make more money, of course. Also, because fulltime jobs require fulltime wages and benefits. People aren’t stupid, remember? And people are employers as well as employees. Dad isn’t alone in losing his job on Friday, only to find it listed in the Monday paper for entry level wages. Longevity in employment isn’t always loyalty – it’s a liability to the bottom line. Full time is considered 32-40 hours a week; if one offers only part-time hours, one needn’t offer benefits (paid time off, health insurance, sick leave, etc.), and there is less likelihood of having to dish out overtime if 40 hours is exceeded. As a for-profit business model, it makes sense.

Then there are the contractual employees, often working well above 40 hours a week though overtime pay is a pipe dream. Many nights as a child, I would wake in the night to find my teacher-mother grading papers well into the early hours of the next day. At least teachers have the summers off…except for those that teach summer school, lesson plan, create their blackboards, attend teacher in-services and professional development, pursue continuing education credits, and maybe pick up an extra part-time summer job to help pay for all the little extras that they provide for their students throughout the school year. Education is important; it’s how a person can get ahead. Except machines, AI, and overseas manufacturing have taken a huge chunk of skilled labor jobs off the domestic job market, which leaves a glut of over-qualified individuals. One needn’t have a college degree to work at Starbucks or McDonalds, but one may be competing with those that do for the position. Managerial positions are finite; “get a better job” is this century’s “then let them eat cake!”

Traditionally, employment grounded a person in their community and society. There was stability and safety, and pride in contributing meaningfully to one’s community. Internal promotion was the reward for one’s hard work, loyalty, and longevity with the company. Supposedly, a company once felt that taking care of their employees and families, as well as the broader community, was part of their contract with their workers and location. Today, this sounds more like fantasy than historical fact, and the companies that embody this ethos are among the most highly competitive jobs to land – almost like winning the lottery (an owner of one such company bemoaned the inability to hire all applicants – it is impossible and exhausting to pull a train alone).

Consider these trends/examples:

- A factory merges with another: leadership promises that the jobs of the workers won’t be affected. Within a year, production is moved overseas, the factory is closed, and everyone is laid off (a few are flown overseas to train their foreign replacements first).

- A company decides to “contract” some of their services to outside vendors, such as food service and childcare for workers. These employees are no longer offered the benefits and wages of the parent company, and their status is now a “contractual” employee.

- A job applicant must obtain certification or purchase specialized equipment, tools, and/or uniforms prior to being considered for employment; these items are not reimbursed by the company, nor is employment guaranteed when items are purchased, but potential employment consideration is dependent on having these generally expensive things.

- An employee is required to drive their own vehicle for work (food delivery, taxi services, etc.) and is involved in a car accident. The individual’s private car insurance and company’s insurance determine the other one should pay, so instead of double-coverage, the employee must fight for coverage or be left with the bill.

- A large company decides to merge their human resources department across multiple locations. Employees are left dealing with distant, off-site workers, possibly in a different state with varying laws and paperwork requirements, to work through employment issues.

- A company is bought out, declares bankruptcy or dissolves, but the community is left with a health and environmental nightmare (carcinogens, chemical spills, lead poisoning, abandoned mines, leaking orphaned/abandoned oil and gas wells…).

- A worker is let go, perhaps just before a pay raise, due to a random accumulation of minor infractions, such as tardiness, phone use, number of bathroom breaks, etc. They might apply for a job again in a few months – at entry level wages.

- A plant is mechanized and employees are given the options to: 1. Accept a position at another plant across the country (until that plant also becomes mechanized), uprooting their family and forcing their spouse to quit their job without a guaranteed replacement; 2. Retrain for a limited number of remaining jobs in the plant (that may become mechanized next); 3. Find a different job, while losing their seniority and the benefits they’ve worked for.

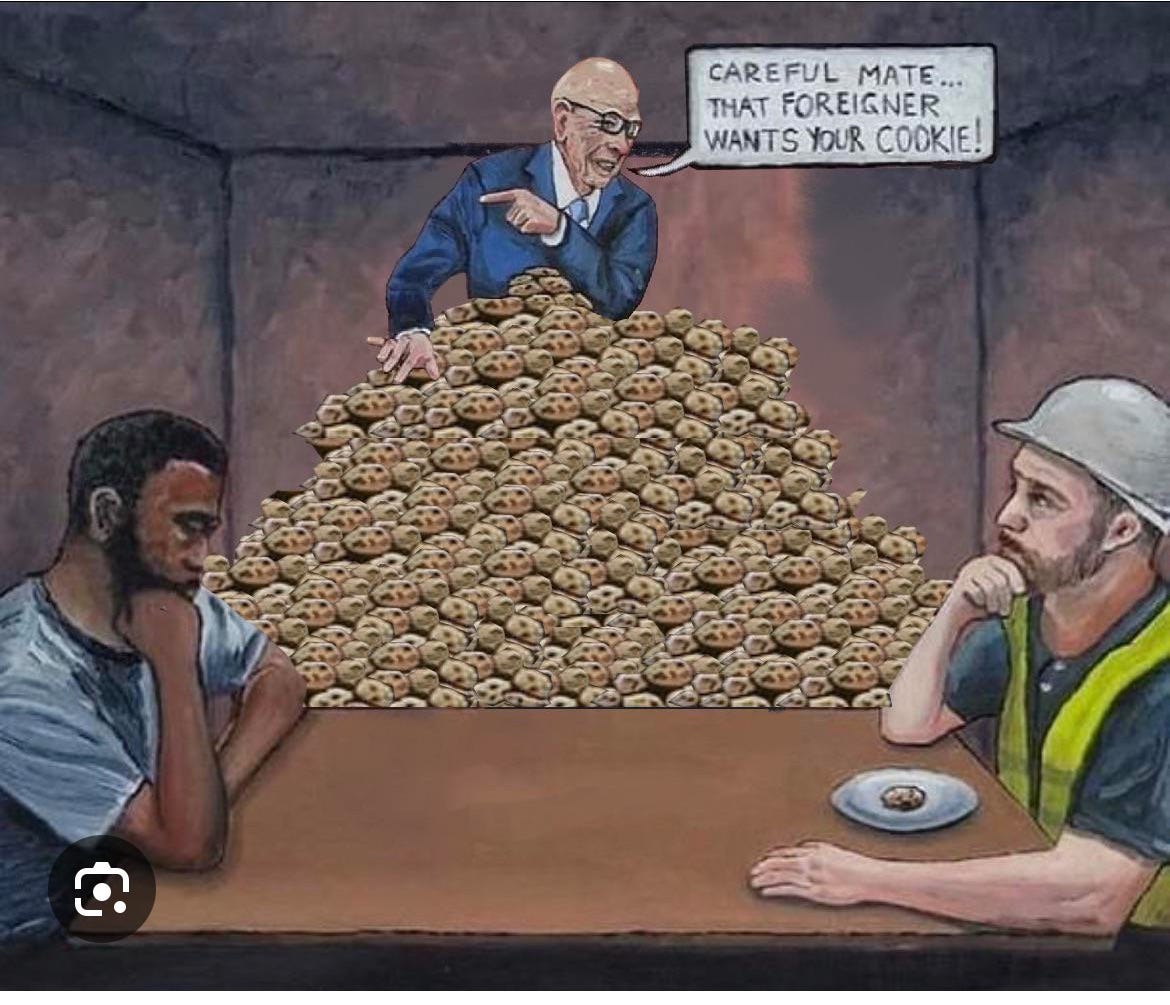

- A plant moves overseas, but the community is told to blame the foreign workers or immigrants in their community for the sudden lack of jobs.

- A friend/family member/acquaintance is earning extra income through a lucrative new company (make-up, vitamins, skincare, clothing, jewelry, etc.) that sells exclusively person-to-person. Wanting to support their American entrepreneurship and gumption, you host a “party” and begin purchasing products from them. After a while, the expense is no longer sustainable and, expecting them to now be self-sustaining with this venture, you stop purchasing the products…as do all their other family, friends, and acquaintances. It turns out they might also be left with unreturnable or unsaleable product, and their finances haven’t improved despite all of their hard work. The purchases have made their MLM supervisors a tidy profit, however.

- A company utilizes a child’s free labor (and irresistible cuteness) to sell their products; this model is ostensibly to raise money for schools/organizations and teach children “entrepreneurship”; however, the money is generally raised from the child’s connections of family, neighbors, and parents’ co-workers/employees and friends, who feel compelled to support the child and their parents through purchases. The more well-connected a family, the more money is raised. Most of the products are unnecessary; few would stop by the store on their way home from work to pick them up, or go out of their way to purchase them from the company itself. (A few schools/organizations are now hosting events (such as “Fun Runs”), where 100% of the donations are raised for the school/organization. Thanks to funding shortfalls, many desperately need the extra cash, and this option allows them to keep all of the funds that are raised.)

- A tipped employee (who makes the federal tipped/sub-minimum wage of $2.13/hour - unchanged since 1991 - $2.33/hour in Wisconsin) fails to earn the $7.25 federal minimum wage through their tips. Their employer by law must make up the difference, however the process for reimbursement is long, arduous, and opaque. It requires the employee to track and calculate their hours and tips, and to show proof. (Watch Tipping: Last Week Tonight with John Oliver, link below, to see how a server might receive a paycheck for $0, or have to actually pay for the privilege of waiting on tables.)

- A 19-yr. old (perhaps already a parent) is paid only $4.25/hour for the first 90 calendar days of employment – the federal minimum wage for the first 90 days of employment for under 20-year-olds ($5.90/hour or $2.13/hour for tipped opportunity in Wisconsin). For students working summer jobs to pay for university, this can limit education opportunities and increase school debt burdens.

While the standard federal minimum wage hasn’t changed in 16 years ($7.25/hour), rent for our 2-bedroom apartment has increased by $345/month in the last 12 years alone (that’s over $4,000/year), while the amenities and services included in that rent have decreased. Property taxes in our area faced similar increases. The cost of living continues to rise, even if wages haven’t. ($7.25/hour x 40 hours = $290/week x 4 weeks = $1,160/month or $15,080/52 weeks) If I understand it correctly, given the rates of inflation, a minimum wage earner today may make the same dollar amount as one did 15 years ago, but the purchasing power of their money is worth roughly 2.5% less each year…unless someone has averaged a 2.5% wage increase for the last 15 years, their income hasn’t kept up with the rate of inflation and their money hasn’t the same buying power as it had 15 years ago: their “wage worth” has technically decreased while the costs of living, goods and services have drastically increased.

Then there is the trend of product planned obsolescence. Household appliances, which once could reliably last 20 years, are lucky to go their full five. Energy efficient models advertise their “green” benefits, but landfills are littered with models that are planned to be replaced, not repaired, when their limited warranty wears off. And consumers are expected to buy yet another round. While complaints abound of “those young people” needing the latest and greatest, there is a very real struggle of modern-day expectations. High school students long ago may have researched term papers in the library, writing them in pen if typewriters weren’t available, but if one doesn’t have access to online information or access to writing software and a printer, the paper may not even be accepted. Internet access is necessary for many of today’s students; many classes and/or schools are held either in part or entirely online – many elementary school students are required to log on during “snow days” when in-person school is cancelled. Schools, governments and internet providers scrambled to fill the “internet gap” for their learners during the pandemic. What once was inconceivable has moved from luxury to necessity and should be considered comparable to running water, sanitation and electricity. Yes: well water, outhouses, and kerosene lanterns are still a “thing”. No: they aren’t realistic, sanitary, or safe options for most of the population today and their replacements should be considered necessities, not luxuries.

Back to the mom with seven jobs. Refusing workers a living wage has externalized many costs that are born every single day in families and communities throughout our nation. During the pandemic, President Trump signed the Child Tax Credit checks, which under President Biden with the 2021 CTC expansion “lifted nearly 3 million children out of poverty and reduced food insufficiency by 26 percent among all US households with children, [though] Congress failed to extend the legislation at the end of 2021*”. In Season 2, Episode 14 on the popular show, The Big Bang Theory, Sheldon tells Penny, “You know, it occurs to me: you could solve all of your problems by obtaining more money.” Penny replies sardonically, “Yes, it occurs to me, too.”

This nation faces a glut of issues, many of which are caused or exacerbated by a lack of money. Homelessness? Job insecurity? Mental health? Depression? Relationship stressors? Bullying? Drug abuse? Chronic illness? Childcare? Food insecurity? Gangs? Delinquency? Child labor? Burn out? Suicide? The stress that workers are feeling is very real. We know the solution that works within this system: more money. It isn’t working harder: that only blames the victims of this system. Whether it comes from their employer, a social safety net from the government, family and friends, or strangers on Go Fund Me, more money is a Band-Aid that fixes a lot but doesn’t resolve the deeper issues. Deep down, we know that a mother shouldn’t have to juggle seven different part time jobs to provide for her children. Thanks to workplace innovations, workers are more efficient than ever. Instead of job security, shorter work weeks and larger pay checks, people are working more, paid less, and threatened with layoffs. Why is our system so broken?

The rising tide of Reaganomics was supposed to lift all boats. However, the masses have been kicked off the upgraded super yachts of the billionaires and the middle class is overwhelmed with bailing the water out of their leaking lifeboats while trying to pull others out of the water. The poor are scrambling to desperately catch and hold onto the too-few life jackets being occasionally tossed in to keep from sinking. In a for-profit world, the system is working exactly as intended. The working, consuming masses are providing the profit-makers with a lot of money. But is this the world we want?

Some references for the ramblings:

First, an aside: There’s a poor man’s Catch-22 in which society uses the mythical experiences of their frontier/pioneer grandparents and great-grandparents to minimize the impacts of “going without,” while also harshly judging the poor for the results of that "lack”; however, if a child’s parents are too poor to have running water, electricity, garbage pick-up, or a home and food, we should consider providing those things before taking the kids away from the parents (abuse and neglect are obviously separate issues). Poverty is not a moral failing: it is a failure of society to pay a living wage. Years ago, a middle school student was made fun of for smelling badly – it turns out that the mom was washing the family’s clothing in their bathtub in the middle of a cold Wisconsin winter, as they couldn’t afford the laundromat. For any trucker paying $17 for a shower, or homeless/car bound family cleaning up in a library bathroom, personal hygiene is a luxury.

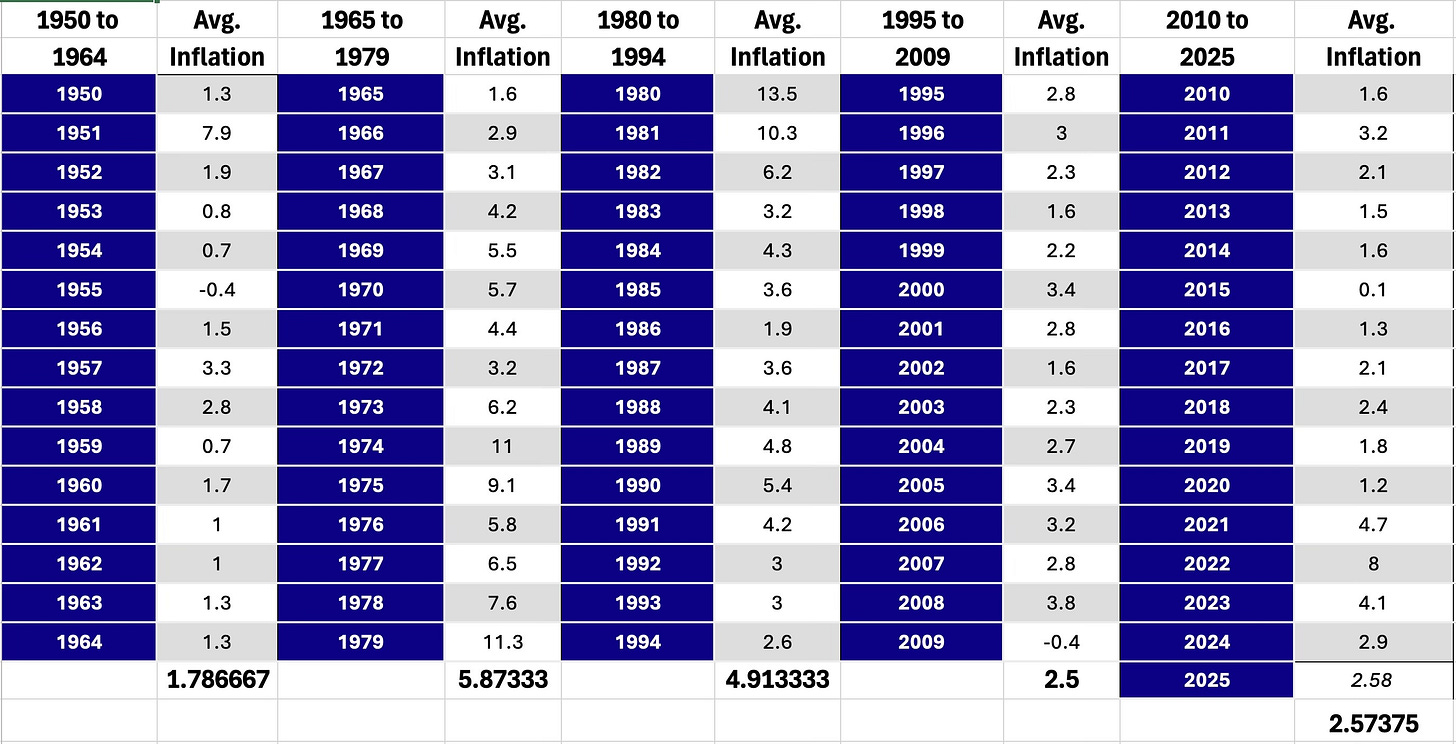

Wages and Inflation Averages every 15-year period since 1950 (75 years):

2010-2025 (15 ½ years) – $7.25 – No increase (0%)

Average yearly rate of inflation (2010 to 2024): 2.58%

(Note: 4 of the 5 highest rates of inflation during this period occurred in the last 4 years at 8%, 4.7%, 4.12%, and 2.9% (2024)…the lowest rate was 0.12% in 2015). Without the highest and lowest 2 numbers, the inflation rate is 2.35%

1995-2009 (15 years) – $7.25 from $4.25 – $3 increase (nearly 70.59%)

Average yearly rate of inflation (1995 to 2009): 2.5%

(Note: Inflation remained mostly steady; the highest at 3.84% in 2008, the lowest at -0.36% in 2009; without highest and lowest, it is 2.62%)

1980-1994 (15 years) – $4.25 from $3.10 – $1.15 increase (37.1%)

Average yearly rate of inflation (1980 to 1994): 4.92%

(Note: Rates of inflation were insane in the early ‘80’s – 13.55%, 10.33%, and 6.13% the first 3 years respectively. Without the highest (1980) and lowest – 1.9 of 1986 – the average is still a whopping 4.49%. For anyone that has “heard the stories”; they are true. Inflation was insane; fortunately, wages still saw an increase. But what about the 15 years before?)

1965-1979 (15 years) – $3.10 from $1.25 – $1.85 increase (148%)

Average yearly rate of inflation (1965 to 1979): 5.87%

(Note: Rates fluctuated wildly, generally increasing throughout the decade and a half. Without the highest – 11.25 in 1979 – and lowest – 1.59 in 1965 – the average rate is still 5.78% for this period.)

1950-1964 (15 years) – $1.25 from $0.75 – $0.50 increase (66.67%)

Average yearly rate of inflation (1950 to 1964): 1.79%

(Note: Inflation rates were ridiculously steady in this period…and low. 1951 was the largest anomaly at 7.9%; overall the average was still less than 2%.)

From: https://www.usinflationcalculator.com/inflation/historical-inflation-rates/#google_vignette

https://dwd.wisconsin.gov/er/laborstandards/minimumwage.htm

https://www.wpr.org/art/film-art/new-doc-explores-uniroyal-departure-from-western-wisconsin

https://imgur.com/gallery/not-enough-cookies-to-show-true-disparity-jNPaCZV

https://pjhollis123.medium.com/careful-mate-that-foreigner-wants-your-cookie-aba1c536b0d8

https://en.wikipedia.org/wiki/Let_them_eat_cake

https://www.macrotrends.net/global-metrics/countries/USA/united-states/inflation-rate-cpi

Math (it has been a while) and Table:

Percentage Increase = (Final Value – Initial Value) / (Initial Value) * 100

If a quantity increases by 90%, this means that it grows by 90% of whatever its initial value was. The final value reached will therefore be 190% of that initial value.

https://www.usinflationcalculator.com/inflation/current-inflation-rates/#google_vignette

Information taken from: https://www.usinflationcalculator.com/inflation/historical-inflation-rates/#google_vignette

*The highest yearly inflation rate I found since 1914 was in 1918 at 18%.

Because vast amounts of money are incomprehensible to most people: